-

Americas

-

Asia & Oceania

-

A-I

J-Z

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

Regions

-

Americas

-

Asia & Oceania

-

Europe

-

Middle East & Africa

-

Americas

-

Asia & Oceania

-

Europe

Europe

- Adriatic

- Belgium

- Bulgaria

- Czech Republic

- Deutschland

- España

- France

- Greece

- Hungary

- Ireland

- Israel

- Italia

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

SOLUTIONS

-

Research & Development

-

Real World Evidence

-

Commercialization

-

Integrated Global Compliance

-

Technologies

LIFE SCIENCE SEGMENTS

HEALTHCARE SEGMENTS

- Information Partner Services

- Financial Institutions

- Public Health and Government

- Patient Associations

- Payers

- Providers

THERAPEUTIC AREAS

- Cardiovascular

- Cell and Gene Therapy

- Central Nervous System

- GI & Hepatology

- Infectious Diseases and Vaccines

- Oncology

- Pediatrics

- Rare Diseases

- View All

Harness the power to transform clinical development

Reimagine clinical development by intelligently connecting data, technology, and analytics to optimize your trials. The result? Faster decision making and reduced risk so you can deliver life-changing therapies faster.

Research & Development OverviewResearch & Development Quick Links

Real World Evidence. Real Confidence. Real Results.

Generate and disseminate evidence that answers crucial clinical, regulatory and commercial questions, enabling you to drive smarter decisions and meet your stakeholder needs with confidence.

REAL WORLD EVIDENCE OVERVIEWReal World Evidence Quick Links

See markets more clearly. Opportunities more often.

Elevate commercial models with precision and speed using AI-driven analytics and technology that illuminate hidden insights in data.

COMMERCIALIZATION OVERVIEWCommercialization Quick Links

Service driven. Tech-enabled. Integrated compliance.

Orchestrate your success across the complete compliance lifecycle with best-in-class services and solutions for safety and quality.

COMPLIANCE OVERVIEWIntegrated Global Compliance Quick Links

Intelligence that transforms life sciences end-to-end.

When your destination is a healthier world, making intelligent connections between data, technology, and services is your roadmap.

TECHNOLOGIES OVERVIEWTechnology Quick Links

CLINICAL PRODUCTS

COMMERCIAL PRODUCTS

COMPLIANCE, SAFETY, REG PRODUCTS

BLOGS, WHITE PAPERS & CASE STUDIES

Explore our library of insights, thought leadership, and the latest topics & trends in healthcare.

DISCOVER INSIGHTSTHE IQVIA INSTITUTE

An in-depth exploration of the global healthcare ecosystem with timely research, insightful analysis, and scientific expertise.

SEE LATEST REPORTSFEATURED INNOVATIONS

-

Connected Intelligence

-

AI & Machine Learning

-

Human Data Science Cloud

-

IQVIA Innovation Hub

-

Decentralized Trials

-

Genomics

WHO WE ARE

- Our Story

- Commitment to Public Health

- Code of Conduct

- Environmental Social Governance

- Privacy

- Executive Team

NEWS & RESOURCES

Unlock your potential to drive healthcare forward

By making intelligent connections between your needs, our capabilities, and the healthcare ecosystem, we can help you be more agile, accelerate results, and improve patient outcomes.

LEARN MORE

AI & Machine Learning with a healthcare IQ.

Artificial intelligence is accelerating opportunities. Realizing the benefits for healthcare requires the right expertise. Together, we can solve the problems of today, and drive the breakthroughs of tomorrow.

LEARN MORE

Your healthcare data deserves more than just a cloud.

The IQVIA Human Data Science Cloud is our unique capability designed to enable healthcare-grade analytics, tools, and data management solutions to deliver fit-for-purpose global data at scale.

LEARN MORE

Innovations make an impact when bold ideas meet powerful partnerships

The IQVIA Innovation Hub connects start-ups with the extensive IQVIA network of assets, resources, clients, and partners. Together, we can help lead the future of healthcare with the extensive IQVIA network of assets, resources, clients, and partners.

LEARN MORE

Proven, faster DCT solutions

IQVIA Decentralized Trials deliver purpose-built clinical services and technologies that engage the right patients wherever they are. Our hybrid and fully virtual solutions have been used more than any others.

LEARN MORE

Unlock the power of genomic research.

IQVIA enables genomic research via global access to a network of genomic-clinical data, proprietary technologies that enable federated analytics, and therapeutic area & bioinformatics expertise to help you answer your most pressing research questions.

LEARN MOREWORKING AT IQVIA

Our mission is to accelerate innovation for a healthier world. Together, we can solve customer challenges and improve patient lives.

LEARN MORELIFE AT IQVIA

Careers, culture and everything in between. Find out what’s going on right here, right now.

LEARN MORE

WE’RE HIRING

"Improving human health requires brave thinkers who are willing to explore new ideas and build on successes. Unleash your potential with us.

SEARCH JOBS- Blogs

- Quantifying the Impact of R&D Trends on Trial Productivity

The cost to develop new biopharmaceuticals is rising, while there are an increasing number of compounds in development. These parallel trends make a focus on productivity – the results of the efforts researchers and sponsors undertake – critical for both investors and the companies doing research or marketing the discoveries of others.

Predicting and managing clinical-trial productivity is immensely important to every aspect of developing new medical treatments and bringing them to market successfully. To examine historical and future clinical trial productivity trends across therapy areas, a recent IQVIA Institute report, The Changing Landscape of Research and Development puts forth a proprietary Clinical Development Productivity Index that reflects changes in trial complexity, success and duration.

I invite you to download the full report, which details the current activity within research and development (R&D), the features and development of pipeline therapies, the productivity levels of the clinical development process and how key trial-trends will transform clinical development over the next five years.

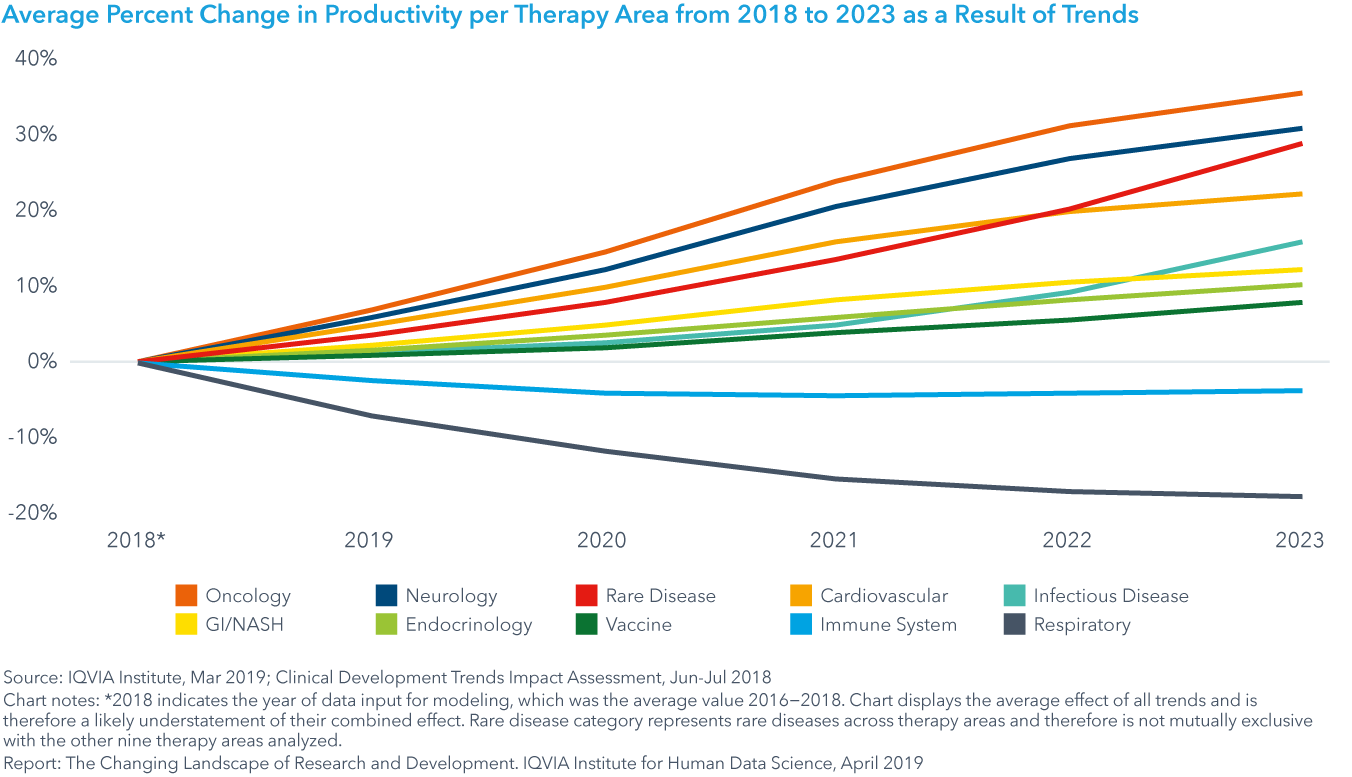

The big picture: future trial productivity by therapy area

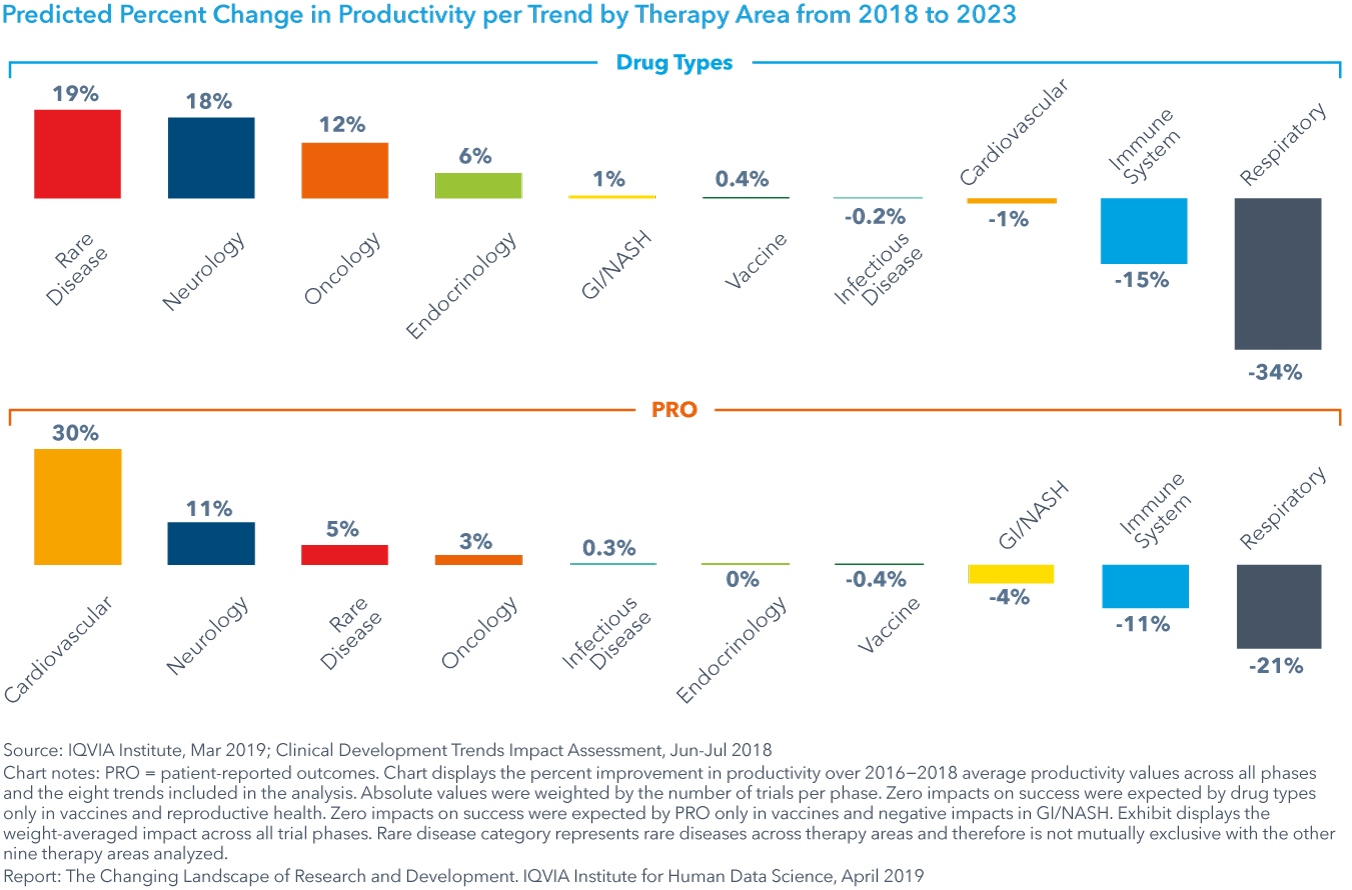

Oncology, neurology, rare disease and cardiovascular trials will see the most significant increases in productivity on a percent basis over the next five years, while both respiratory and immune system trials will see decreases in productivity (see exhibit).

Oncology productivity will be greatly improved by the development of patient pools that will accelerate trial recruitment and biomarkers, improving success rates. For neurology, the most significant impact will come from digital health, along with biomarkers and regulatory changes.

Therapy areas showing worse or unimproved productivity are being affected primarily by changes in drug type and by patient-reported outcomes (PROs). Though success rates may rise from these trends, trials are projected to become longer and more complex.

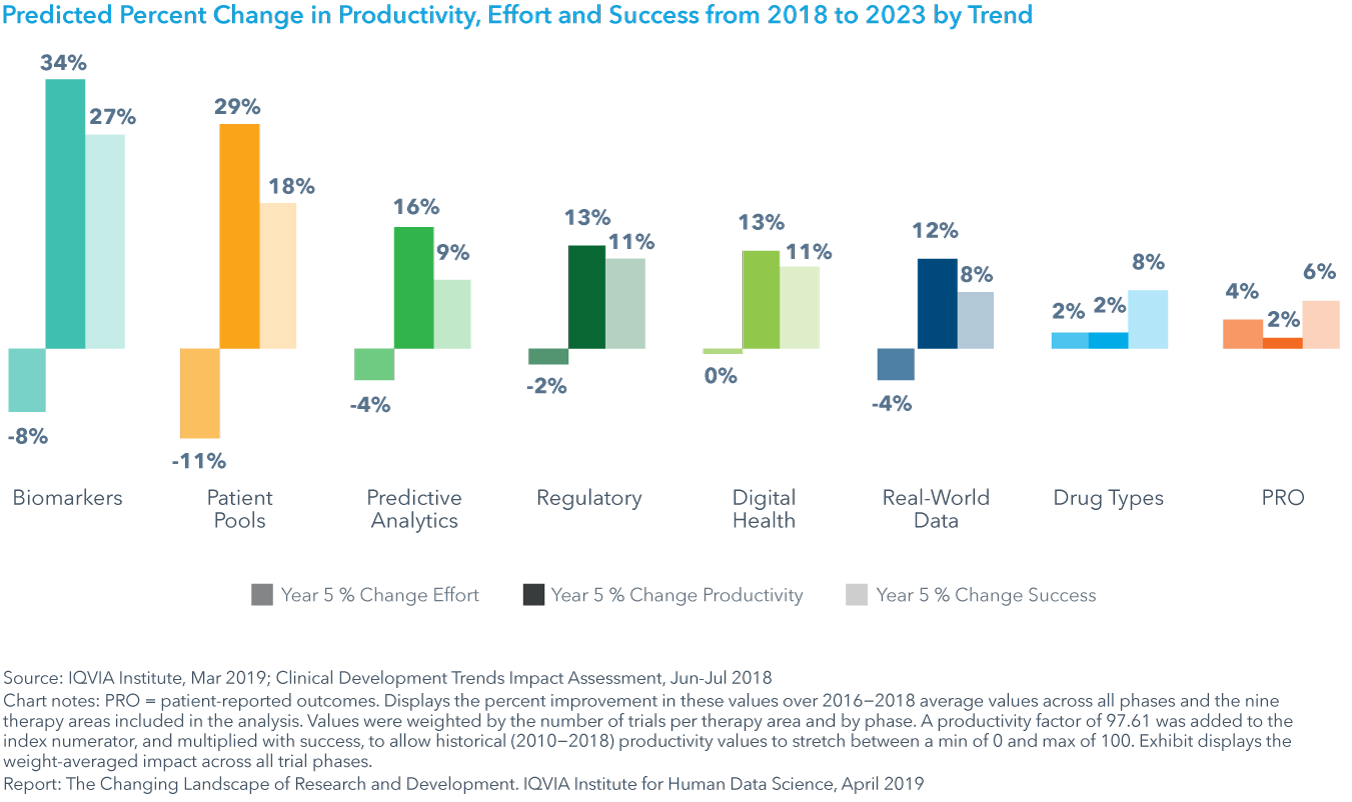

The trends with the largest predicted increase in productivity

The largest average positive impacts on productivity, across all therapy areas, will come from the use of biomarkers (34% improvement) and the development of pools of pre-screened patients to aid in trial recruitment (29%) (see exhibit).

Biomarkers are expected to yield consistently high productivity improvements of over 45% across four therapy areas: GI/NASH, rare disease, neurology, and cardiovascular, in addition to oncology.

In oncology, pools of pre-screened patients and biomarkers will yield productivity improvements as high as 104% and 71%, respectively. However, the impact of each of these trends on respiratory trials is negative, making trials longer and more complex.

Predictive analytics is expected to have significant positive impact on productivity in all therapy areas with the exception of immune system disorders, which include allergy, immunology and rheumatology trials.

Trends with mixed impact on productivity

Shifts in drug type will increase productivity in several therapy areas, including rare disease, neurology, oncology and endocrinology (see exhibit). For all areas where productivity is declining due to shifts in drug types – such as respiratory, reproductive health and immune system - increases in trial complexity or duration is expected to outweigh the positive effects of increased success.

Predictive analytics and patient-reported outcomes (PRO) will yield large increases in trial success for immune system and respiratory treatments, though their effect is small in other therapy areas.

Trial productivity by phase

The most significant productivity changes will occur in Phase II trials, with Phase I trends having zero impact on trial complexity, effort or success. For example, digital health trials, while having 14 and 16% impacts across therapy areas in Phase II and III, will have virtually no effect on Phase I trials. While regulatory changes will have a 10−16% impact across phases, this effect will be highest in Phase II trials likely due to recent regulatory efforts to accelerate approvals of innovative therapies. Predictive analytics will have its greatest impact in Phase III, with a 20% increase in productivity. Patient-reported outcomes (PROs) will have little-to-no effect on average across all trial phases.

While both Phase II and III trials will be significantly impacted by most trends, not all trends yield positive changes. Changes in the drug types being tested will decrease Phase III productivity by -6%, likely due to increased trial duration.

The R&D outlook

The large number of ongoing research programs, and the rising bar for innovation across a range of therapy areas, puts a necessary focus on productivity. Investors need to have clear, actionable metrics to understand if money is being well-spent, and companies need actionable strategies to optimize success, manage costs and mitigate risks. The full study presents the most impactful strategies to achieve these objectives, supported with data and analysis, and reveals a useful roadmap for improving R&D in the future.