The following blog expands on a presentation from the recently launched IQVIA Market Access Master Class series. This year, IQVIA will be visiting an array of topics to go deeper into complex market dynamics impacting the life sciences industry. The Master Class is a free monthly series targeted to those who seek a more substantive understanding of how payers, patients, policymakers, and other stakeholders’ behaviors converge and impact life sciences. The first stop in the series is the Inflation Reduction Act which is emerging to be transformative legislation for the entire industry and is the number one trend we are following this year. As economics shift across stakeholders, both pharmaceutical manufacturers and payers will have substantially higher liabilities. The resulting impacts are complex, far reaching, and play out over the next decade. -- Luke Greenwalt, VP, IQVIA Market Access Center of Excellence

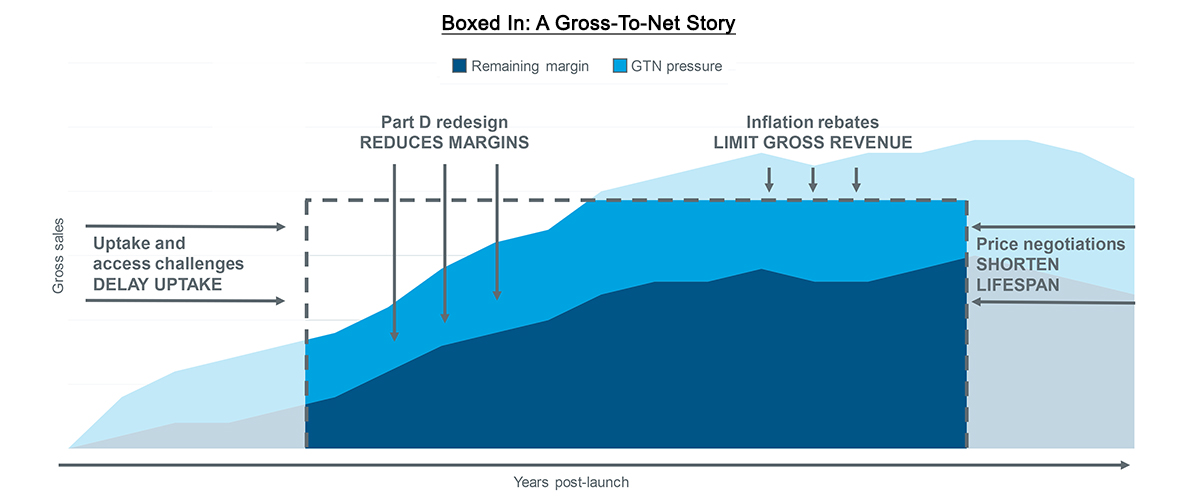

IQVIA recently published Making the Right Moves Part 1. The blog underscored how the complex dynamics of Medicare Part D redesign will drive liability increases for both biopharma manufacturers and insurers. Such liabilities are expected to lead to tighter payer control and challenge brands’ gross-to-net. Yet the Inflation Reduction Act (IRA) has other major provisions with the potential to further challenge drug prices and potentially shorten drugs’ lifespans.

Compressed margins and restrained growth

Even before the IRA, drug price increases were slowing down. Several drug manufacturers had already pledged to limit their price increases to the single digits and had also committed to price transparency. As a result, average, unadjusted price growth was down to 4.9% in 2022, less than half the rate it was eight years ago. Net prices have also slowed over time. For some brands, net prices even decreased (Drug Channels). Nevertheless, pricing has been an important strategic lever for launch and established brands alike. As contracted rebates increase over time, 340B programs expand, utilization management delays uptake, and other trends put pressure on margin, the ability to take price increases has alleviated some of the impact. Gross-to-net pressures will only increase as the IRA’s Part D redesign will both directly and indirectly drive margins even lower while also limiting the degree to which manufacturers can compensate via price adjustments.

The IRA features two provisions that target pharmaceutical brands’ list prices, one of which has already begun to take effect. CMS will now collect rebates on any price increases that outpace the urbanized consumer price index (CPI-U). These penalties have already begun to accrue, but manufacturers may not receive invoices from CMS until 2025, making long-term financial planning extremely important for some brands. This further complicates the strategic considerations manufacturers must weigh for price increases in commercial and cash channels against penalties in Medicaid and Medicare. They must also estimate the extent to which existing price-protection contracts could compound with new penalties in Medicare, potentially mimicking the net negative margin effect that is expected when the Medicaid AMP cap is removed in 2024.

Source: IQVIA US Market Access Strategy Consulting

As the policy continues to evolve – particularly in light of ongoing rulemaking and the proposed budget for the 2024 fiscal year – drug manufacturers, patients, providers, and other industry stakeholders are seeking to better understand and prepare for its effects.

Price negotiation eligibility and impactBy September of this year, CMS will publish the first list of drugs selected for price negotiation in 2026. In advance of this publication, CMS has released a new guidance document focusing on clarifications to the eligibility and negotiation processes. The new guidance establishes a broad application of Maximum Fair Price (MFP). Furthermore, it removes some of the strategic options that were previously considered safe havens for brands facing negotiation.

- Product grouping: Negotiated price will apply to all forms, strengths, and dosages of a single moiety, ingredient, or fixed-dose combination. This means that line extensions, authorized generics, and other versions of the same molecule will all be subject to the MFP at the same time.

- Single orphan designation: Despite advocates’ best efforts, CMS clarified that only products with a single orphan indication will be ineligible for price negotiation. Products with multiple orphan indications or other, non-orphan indications will remain eligible.

- Robust and meaningful competition: Nine months of data-validated, multi-source competition is required to either remove an innovator/reference from the negotiated drug list or delay its potential addition to said list. The mere approval of a generic or biosimilar is insufficient.

Yet, despite the improved specificity, it remains to be seen how key elements of the new language will be implemented. For example, what level of biosimilar or generic uptake will CMS consider “robust and meaningful”? What determines a “fair” price?

Source: IQVIA US Market Access Strategy Consulting

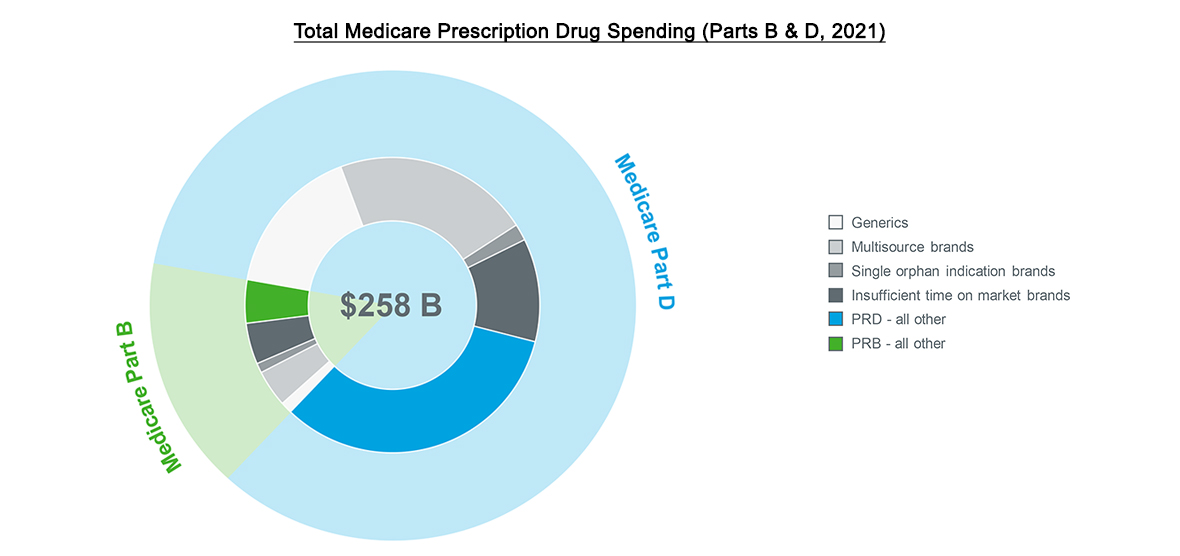

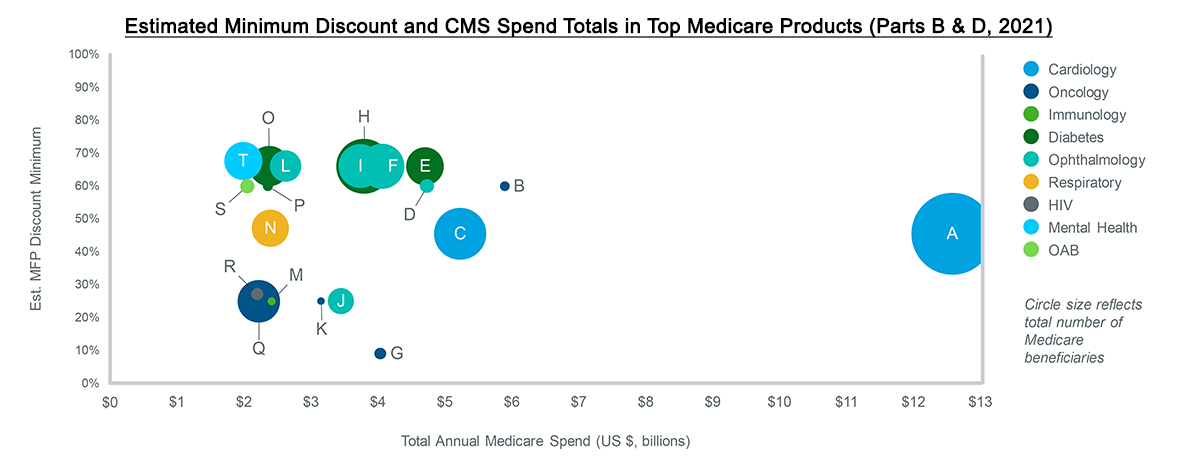

All brands must assess their level of exposure to IRA-related changes, along with the likelihood and impact of price negotiations. It is expected that brands with little rebate activity are particularly at risk as CMS may seek to alleviate costs in areas that have thus far not experienced net price or market pressures. And while brands with high total spend are obvious targets, CMS may also select smaller brands if their MFP could pressure net prices to decline for other, non-eligible brands in the same therapeutic areas.

Drug price negotiation will use either a statutory discount (determined by a drug’s time on the market) or net price – whichever costs less – as the starting point. From there, CMS plans to incorporate manufacturer financials, third-party evaluations, and Medicare claims data. Advocacy groups will also have a chance to weigh in and share data related to the patient experience and drug impact. Notably, the latest guidance from CMS requires that any comparative clinical effectiveness research will not use metrics that value some lives more than others, such as some uses of Quality Adjusted Life Years (QALYs). Nevertheless, there is no set formula in determining the value of a drug with all of these inputs, leaving many to wonder what will ultimately drive CMS’ decisions. Manufacturers need to prepare a robust evidence strategy in readiness for future negotiations.

Source: IQVIA US Market Access Strategy Consulting

CMS is, however, likely to consider comparisons between negotiated brands and other treatment alternatives. The organization has not specified what it would interpret as an alternative, so manufacturers must prepare for a scenario in which MFP could land their net prices in accordance with first line generics, ex-U.S. prices, or other price benchmarks. These, along with the many other scenarios for MFP, effectively shorten the lifespan of a drug by driving net prices to levels that mimic genericization – several years ahead of schedule. The Biden administration’s budget proposal for fiscal year 2024 could accelerate the negotiation timeline even more as it currently proposes to shorten eligibility to five years after launch (instead of nine and thirteen for small and biologic molecules, respectively).

With so many uncertainties remaining, it can be challenging for providers, payers, and manufacturers to plan for the changes ahead. The mechanics for making MFP available to patients have yet to be worked out, which can make forecasting and planning even more difficult. It is possible that price limits in Medicare, in conjunction with access hurdles and rebates, could challenge the overall viability of Medicare access for some brands. At the very least, manufacturers will need to be flexible and detailed in their long-term strategies.

On the other hand, brands may experience some benefits from price negotiations. For brands with an MFP, inflation-based price increases are guaranteed, and Part D liabilities do not apply. They are also guaranteed coverage, though the type and quality of that coverage is not guaranteed. If patients experience meaningful reduction in out-of-pocket costs, they may become more adherent and drive volume. In the end, each situation will be unique with its own set of variables and possible outcomes.

Uncertainties and consequences

As IQVIA continues to monitor the IRA and prepare for shifts in the industry, we must also consider the long-term and potentially unintended consequences of price negotiation and its eligibility details.

- Will the grouping of moieties and ingredients for price negotiation disincentivize incremental innovations that still benefit patients either by experience or outcome?

- Could the grouping of moieties and ingredients for price negotiation extend coverage to formulations of drugs that are not covered by Medicare? Will that affect Medicare’s MFP determination or likelihood of negotiating at all?

- Could employers, IDNs, and other stakeholders petition for and even receive access to MFP – either through rebates or legislation?

- Will providers, particularly with smaller clinics, be forced to avoid MFP medicines because the burden of maintaining multiple inventories and floating costs is insurmountable?

- To what extent will payers tighten formulary restrictions and extract higher rebates both within Medicare for negotiated TAs or in other payer channels such as commercial?

- If drug prices come down, but premiums do not, where will policymakers turn next?

- If payers respond by reducing formulary access to gain more contracting leverage, how will consumers respond to less choice?

IQVIA will continue to be at the forefront of tracking and quantifying these and other unanswered questions as we move towards a new industry landscape in the years ahead.

Related solutions

Gain high value access and increase the profitability of your brands