The following blog is an excerpt from the recently launched IQVIA Market Access Master Class series. This year, IQVIA will be visiting an array of topics to go deeper into complex market dynamics impacting the life sciences industry. The Master Class is a free monthly series targeted to those who seek a more substantive understanding of how payers, patients, policymakers, and other stakeholders’ behavior converge and impact life sciences. The first stop in the series is the Inflation Reduction Act which is emerging to be transformative legislation for the entire industry and is the number one trend we are following this year. As economics shift across stakeholders, both pharmaceutical manufacturers and payers will have substantially higher liabilities. The resulting impacts are complex, far reaching, and play out over the next decade. -- Luke Greenwalt, VP IQVIA Market Access Center of Excellence

In 2022, the expansive Inflation Reduction Act (IRA) was signed into law and included healthcare-specific provisions aimed at reducing drug costs for the federal government and patients. Six months have elapsed since the IRA first passed. Since then, questions around the IRA have shifted. Instead of asking what the IRA says, it is now time to ask what it means for companies’ margins as well as the future of biopharmaceuticals. Already, manufacturers have shared their expectations and concerns, citing new incentives to avoid investing in small molecule treatments or to expand indications for existing treatments that are currently serving one orphan population. Providers, too, have expressed concerns about reimbursement as CMS introduces inflation rebates and negotiated prices in the IRA.

Though much remains to be seen with the IRA’s implementation and unintended consequences, stakeholders across the industry are working to understand and prepare for the changes ahead. IQVIA is no different, relying on data and industry expertise to model the implications of healthcare’s shifting landscape. The following investigation will leverage two fictional brands – IQnumab and VIAtexa – to illustrate the key dynamics.

Drivers of manufacturer liabilities

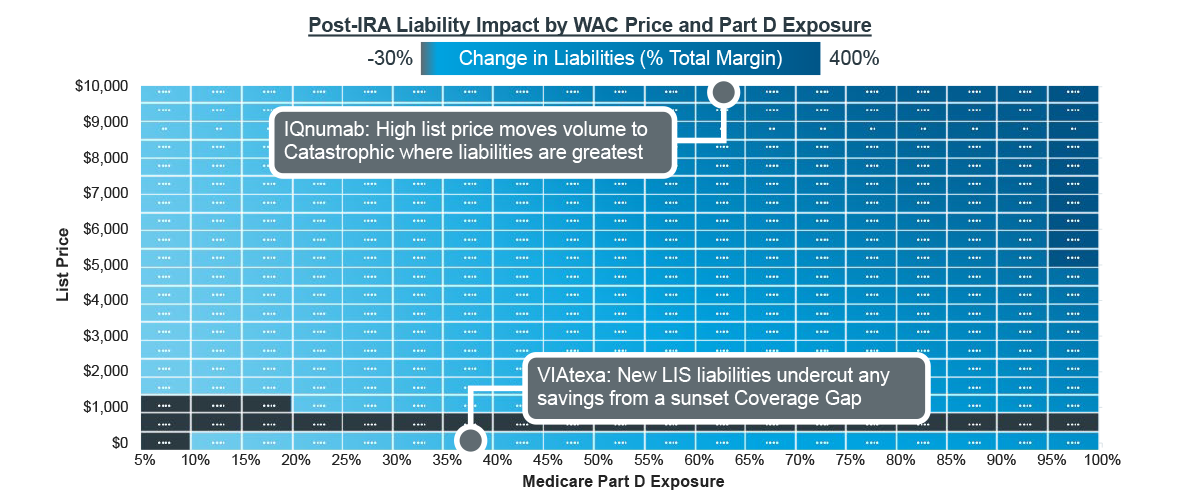

For most self-administered medicines, Medicare adjudicates claims through the Part D pharmacy benefit. These drugs will face new/changing liabilities in 2025 thanks to the IRA, which sunsets manufacturer payments in the Coverage Gap, but also adds liabilities for the Initial Coverage and Catastrophic phases as well as liabilities for low-income subsidy (LIS) claims. The impact this will have on brands’ margins will largely be driven by their list prices and the proportions of volume in Medicare. With few exceptions, brands will face liability increases – quadrupling after the IRA’s Part D re-design in the most extreme scenarios.

Note: For all scenarios, half of Medicare volume is LIS, and patient adherence is perfect. Fictional brands are modeled on collection of analogs.

Source: IQVIA Pharmacy Claims Data; US Market Access Strategy Consulting Analysis

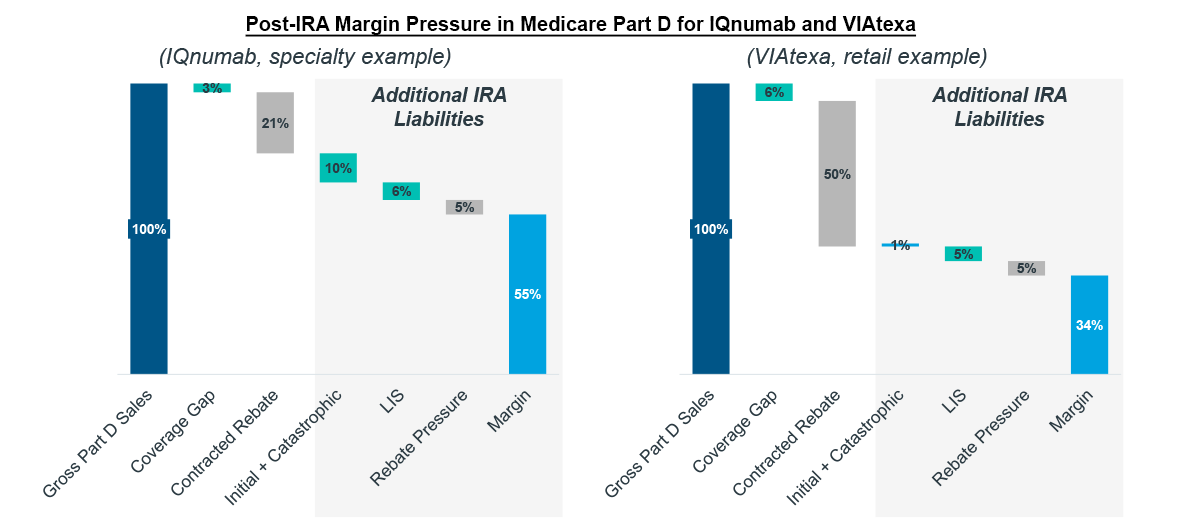

Consider IQnumab, a fictional brand that is expected to launch at a $10,000/month list price after the IRA’s Part D re-design is implemented. The IRA will cause its Part D liabilities to increase by more than 500% compared to what it might have originally forecast. This is largely driven by its anticipated list price, which quickly moves patients through to the Catastrophic phase of coverage as total pharmacy spend accumulates. Before Part D re-design, manufacturers were not liable for any costs in the Catastrophic phase, and thus, faced low proportions of liability. As the IRA introduces 20% liabilities for manufacturers in Catastrophic, IQnumab and other specialty brands with similar pricing will see a dramatic increase in margin erosion within Part D.

Margin is challenged even further by the IRA’s new LIS liabilities for manufacturers (10-20% depending on phase of coverage). VIAtexa, another fictional, inline brand with a list price of $500/month, would have benefitted from Part D redesign with the sunsetting of the Coverage Gap but for added liabilities in LIS. At lower list prices, brands benefit from lower Initial Coverage phase liabilities (10% for manufacturers versus 70% in the Coverage Gap) as patients do not accumulate costs as quickly at lower prices. However, any savings that might result are merely transferred to liabilities on LIS claims where manufacturers have not had any liabilities previously. 28% of Part D patients are enrolled in LIS as of 2020 according to CMS, accounting for approximately half of all prescriptions. LIS patients tend to fill prescriptions more frequently due to their lower cost sharing as they abandon less and stay more adherent. Both factors mean that LIS can make up substantial portions of a treatment’s population and present new liabilities for brand forecasts.

Note: Fictional brands modeled on collection of analogs.

Source: IQVIA Pharmacy Claims Data; US Market Access Strategy Consulting Analysis

Beyond these factors, concomitant spend and patient behavior also drive Part D redesign impact. Concomitant spend may push patients into the Catastrophic phase sooner as drug costs accumulate even more rapidly. Under the IRA, manufacturer liabilities are highest in the Catastrophic phase, making it important for brands to understand their patient populations and budget accordingly. A low-cost treatment might not typically face high Part D liabilities, but if a common concomitant therapy is expensive, liabilities could easily double as the year progresses. Patient behavior can have a similar, driving effect. Adherent patients accumulate more costs and are thus more likely to reach Catastrophic. Compliance is a desired and important behavior within the biopharma industry, but understanding how liability budgets might evolve for chronic treatments over the course of a year will require deeper study.

Second-order effects from Part D redesign

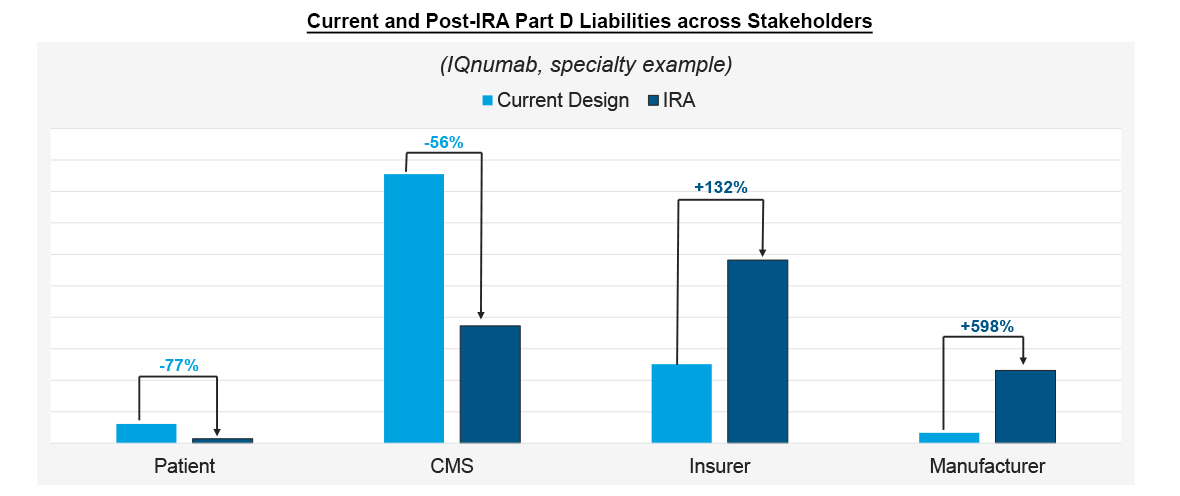

In addition to the increased liabilities for manufacturers, other stakeholders experience their own shifts in liability under the IRA. Using IQnumab as an example, Part D redesign would reduce patient and CMS costs as liabilities shift. The savings for patients on a high-priced drug such as IQnumab could be substantial, especially for those that do not have access to foundations for out-of-pocket support. Similarly, CMS is able to reduce its pharmacy costs by shifting greater liabilities to both drug manufacturers and insurers. Like manufacturers, insurers are expected to see sizeable liability increases – particularly in therapeutic areas with higher prices and Catastrophic exposure. These costs come from a 65% liability in the Initial Coverage phase and a 60% liability in Catastrophic, offsetting much of what used to be CMS costs pre-IRA.

Note: Modeled scenario assumes patient does not receive foundation support in Medicare

Source: IQVIA Pharmacy Claims Data; US Market Access Strategy Consulting Analysis

Insurers have several mechanisms they can employ as a way of mitigating new, IRA-related costs which include raising premiums, negotiating for higher rebates, and managing utilization. These are all likely, second-order effects of Part D redesign. According to the IRA, patient premium increases above 6% will be offset by CMS through 2029. Still, it remains unclear how much premiums will be permitted to increase as CMS must still accept plan bids. In turn, this will affect how much of insurers’ new liabilities will be counteracted by increased premiums.

Rebate demand was already increasing for manufacturers as insurers have consolidated and some markets have grown crowded over the years. Nevertheless, insurers will likely rely on rebates as yet another way to compensate for their increased share of drug costs in Part D redesign. Utilization management tactics such as prior authorizations, step edits, and NDC blocks become a critical tool for negotiating contracts and extracting bigger rebates from manufacturers. Still, there may be a limit for some drugs as to how much higher rebates can go before the economics are not viable for manufacturer contracts. For example, insulins are already heavily rebated and often engaged with price protection agreements. They may not have much more room to concede margin, meaning insurers might be incentivized to look at controlling therapeutic areas that have heretofore enjoyed more open and less costly access. It will be important for the industry to monitor how these effects impact patients and innovation.

“Boxing in” BioPharma

Manufacturers have already made public statements about their concerns regarding the IRA policies. Be it the viability of their pipelines, shifts in their R&D priorities, or changes to their clinical trial strategy, companies have had to consider their response in the face of increasingly compressed margins. Access challenges that delay uptake and profitability will only become more substantial as insurers control utilization more tightly as a reaction to Part D redesign. Manufacturers will face even more gross-to-net pressure as the access that is won in Medicare will face higher liabilities than ever before.

As liabilities and second order effects are expected to put even more pressure on brand margins, developing a scenario-based, strategic response will be necessary for manufacturers. Whether companies are looking to launch successfully and realistically like IQnumab, or preserve margin and access like VIAtexa, forecasts that acknowledge market access dynamics and have the agility to respond to an evolving market event will prove necessary.

Manufacturers’ concerns, however, are not isolated to Part D redesign. Inflation rebates will constrain their ability to use price increases as an antidote for growing rebate pressure. The lifespan of a drug may also be cut short as price negotiation could undermine margin as early as nine-years post-launch for small molecules. These dynamics and more will be discussed in a future IQVIA blog, Making the Right Moves Part II.

The authors would like to thank Neha Swaminathan and Tony Calderone for their contributions to this blog.

IQVIA Market Access Master Class Series

Interested in going deeper into the specific changes laid out in the Inflation Reduction Act of 2022? Click here to view our Master Class webinar and learn about how these changes will affect our industry.

Related solutions

Gain high value access and increase the profitability of your brands