Grow your brand, now and through patent expiry

Introduction

One of the fastest growing areas in healthcare is the oncology market, in terms of the use of therapeutics, healthcare spending, and in the number of products in development1. Behind these advancements are millions of patients living their lives with a life-altering disease. While the number of treatments has increased over time, the ability for patients to access and initiate their therapy still remains a looming challenge for many.

Some of these challenges are well documented. A recent IQVIA paper highlighted how payer exclusions of oncology treatments, despite often being considered an unofficially protected class, are growing at top PBMs2. Additionally, the cost of cancer medications can be prohibitive for many patients. Though Commercial patients heavily rely on manufacturer-sponsored copay cards to reduce costs, Standard Eligible Medicare patients do not have the ability to use copay cards and must rely on foundations to offset costs.

However, there are additional factors in a patient’s journey that have less-studied effects on therapy initiation and maintenance. One of these factors is the order in which a new clinical intervention or therapy is presented during a patient’s treatment progression, often referred to as line of therapy. From a clinical perspective, lines of therapy can include interventions like surgery, radiation, chemotherapy, or therapeutics, either injectables or orals. Every time a patient completes a recommended intervention duration or begins a new type of treatment, they are considered to have progressed to a new line of therapy.

Patients can progress through lines of therapy for many reasons, including intervention efficacy, safety, and durable effect on disease progression. Around three-quarters of all oncology patients progress past a first line of therapy, with around one-quarter making it to at least a third line (data not shown). Recently, the ubiquity of targeted oral oncology treatments has grown; however, they are very often utilized as later-line treatments, as prescribers and insurers may perceive them as either unproven or significantly costlier compared to older, more established treatments. IQVIA is able to track a patient’s journey within our Longitudinal Access and Adjudication Data (LAAD) dataset, and in doing so, can shed light onto barriers to access that may be subtle impediments to either starting or staying on treatment.

Payer control and line of therapy

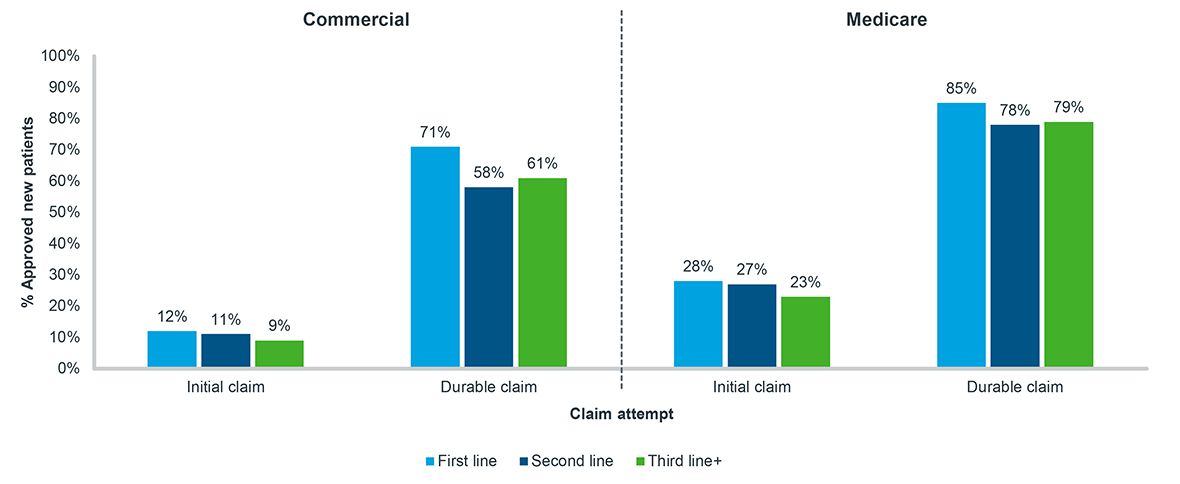

Payer control in oncology has been growing over the past several years, making it increasingly difficult for patients to access their medications3. Among Commercial or Medicare cancer patients, over 70% prescribed a new oral targeted therapy are initially rejected by their insurers (Figure 1). Almost half of these rejected patients are needing to meet additional Prior Authorization requirements (data not shown). Unfortunately, as a patient’s disease progresses and they move through lines of therapy, there is very little change in Commercial and Medicare insurer willingness to approve these targeted oral therapies. Contrary to common belief, a second- or third-line therapy is not immune to the access barriers of a first-line therapy.

Figure 1: Initial and durable new patient approval, oral targeted therapy, all tumor types, 2020-2022

Note: Tumor types include breast, lymphoma, leukemia, prostate, and non-small cell lung cancer;

A 90-day look-forward window is applied from the time of initial attempt to durable claim status

Source: IQVIA LAAD data; US Market Access Strategy Consulting

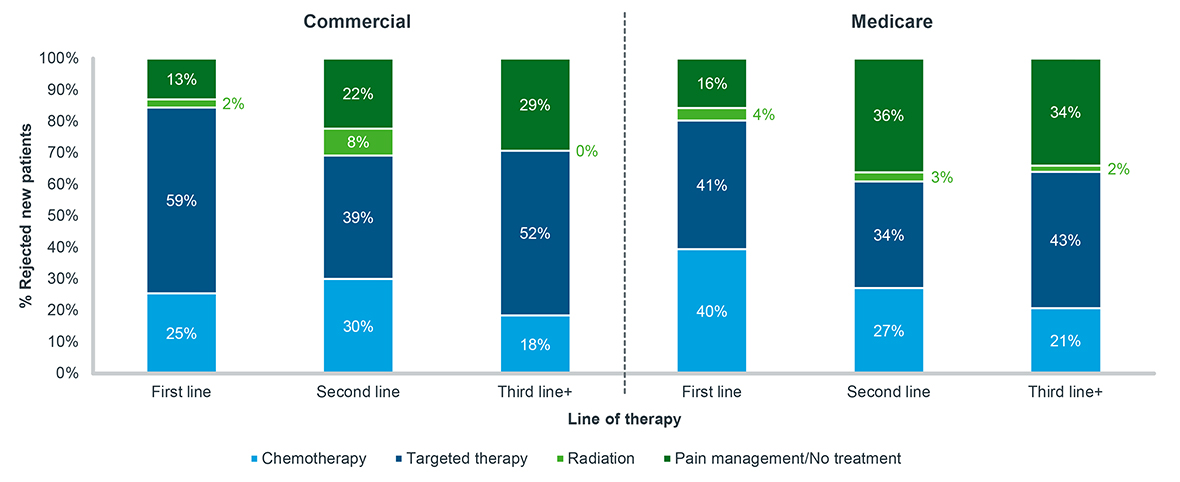

Secondly, as patients experience these rejections in later lines of therapy, the likelihood that they opt for no treatment is likely to double (Figure 2). Patients rejected after attempting a second- or third-line oral therapy fail to ever fill another oncology treatment at a far greater rate than those rejected on their first treatment. For patients that do fill another treatment after a rejection, many opt for another targeted therapy, while others fill harsher treatments such chemotherapy or radiation. Access barriers are difficult enough for patients and can lead to a change in their treatment trajectory, but when combined with an attempt later in treatment progression, they can lead to overall increased patient drop-off.

Figure 2: Post-rejection treatment history, oral targeted therapy, all tumor types, 2020-2022

Note: Tumor types include breast, lymphoma, leukemia, prostate, and non-small cell lung cancer; Patients must have at least 30 days of data post-durable rejection to be included

Source: IQVIA LAAD data, US Market Access Strategy Consulting

Patient abandonment and line of therapy

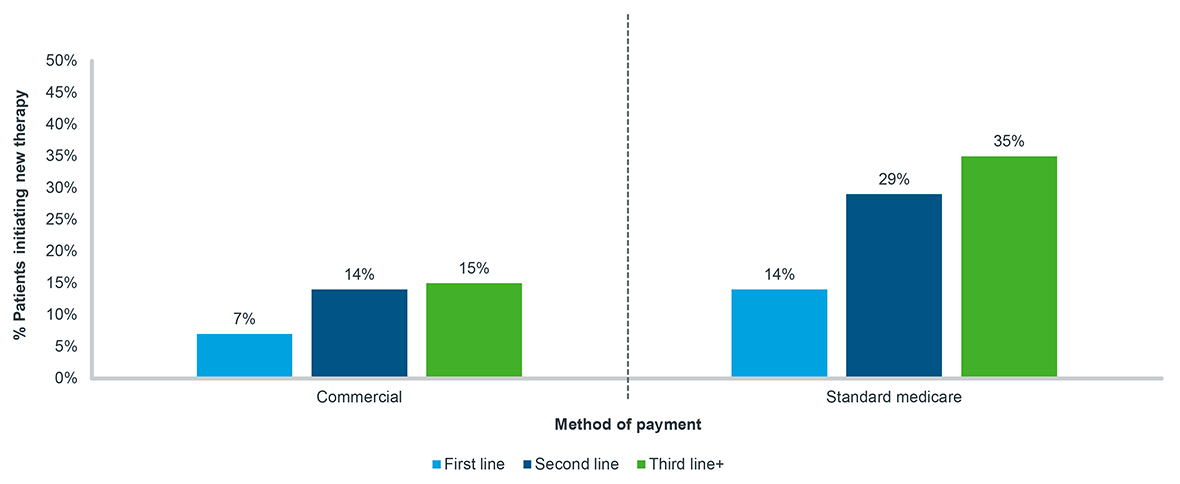

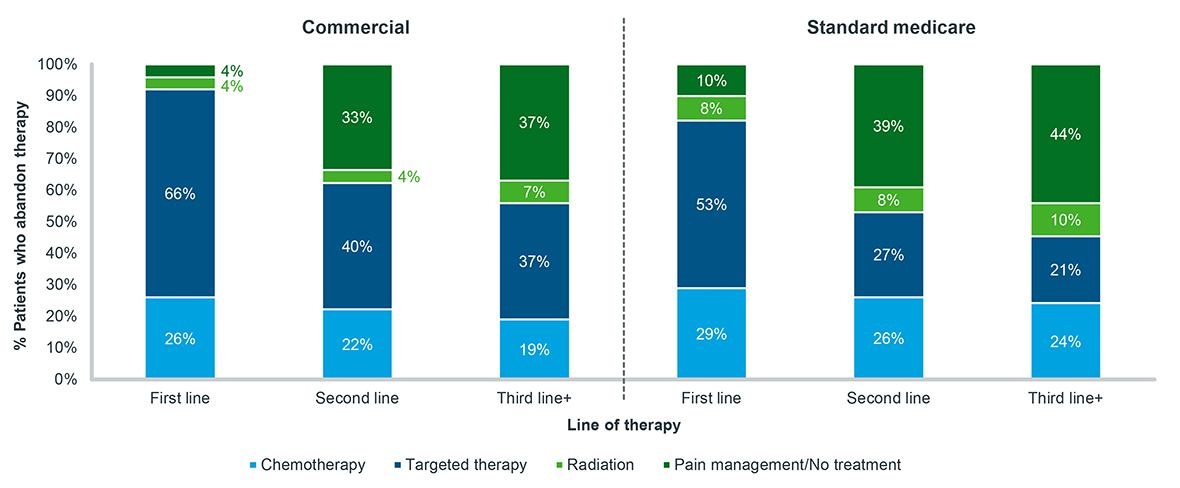

Conversely, among patients whose prescriptions are approved by their insurers, the cost they are required to pay can also be prohibitive. While some level of prescription abandonment due to cost is generally expected, the rate of abandonment among cancer patients progressing through lines of therapy increases substantially (Figure 3). Among both Commercial and Medicare cancer patients, the proportion of patients who abandon therapy between their first and second line of therapy doubles. This is most pronounced for Standard Medicare patients, that is those who do not receive additional government help or subsidies, with almost one-third of approved patients abandoning therapy. Among all patients, an even greater proportion abandon therapy as they progress to the next line of therapy.

Figure 3: New patient abandonment, oral targeted therapy, all tumor types, 2020-2022

Note: Tumor types include breast, lymphoma, leukemia, prostate, and non-small cell lung cancer;

A 90-day look-forward window is applied from the time of approval to final abandonment status

Source: IQVIA LAAD data, US Market Access Strategy Consulting

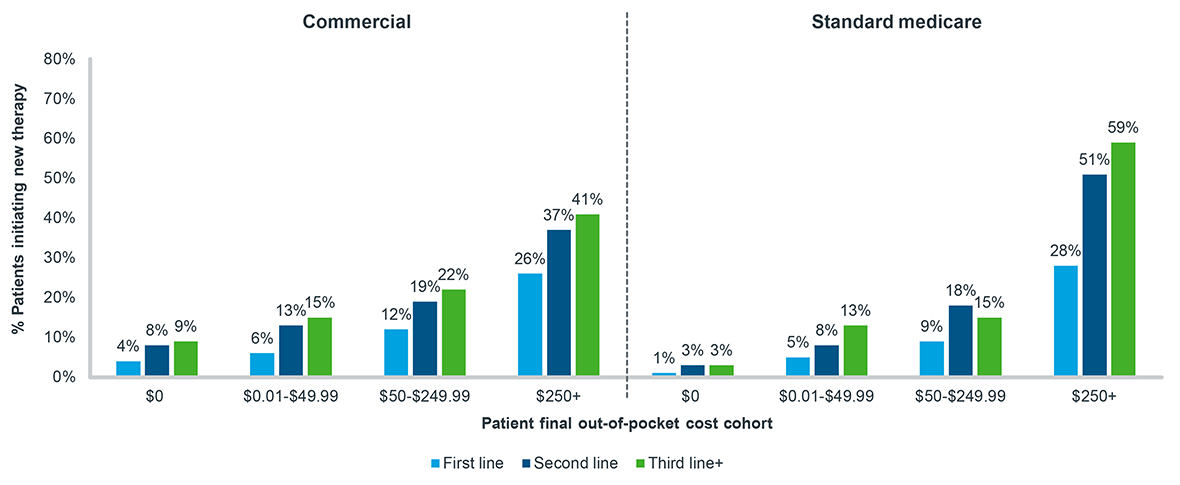

However, the increase in therapy abandonment is not always cost-related. In fact, abandonment increases as line-of-therapy progresses in every patient out-of-pocket cost cohort, including for patients facing no copay whatsoever (Figure 4). Irrespective of cost, patients who have filled prior treatments are more likely not to fill a subsequent one. Put together, though prescription abandonment is a reality in the oncology market, the factors that exist which prevent patients from filling prescriptions are exacerbated by where a patient is in their treatment process. Prescribing an oral oncolytic as a second- or third-line treatment inherently increases the probability of a patient choosing to ultimately forego filling it.

Figure 4: New patient abandonment by patient out-of-pocket cost, oral targeted therapy, all tumor types, 2020-2022

Note: Tumor types include breast, lymphoma, leukemia, prostate, and non-small cell lung cancer;

A 90-day look-forward window is applied from the time of approval to final abandonment status

Source: IQVIA LAAD data, US Market Access Strategy Consulting

For patients who abandon oral therapy as their first line of treatment, almost all eventually fill another treatment (Figure 5). For patients who choose to abandon oral treatment when it is their second line, 33% of Commercial and 39% of Standard Medicare patients never fill another oncology treatment. This proportion is even greater for patients who abandon a third or greater line of therapy. For patients who have been exposed to even just one treatment already, the choice to give up on a subsequent therapy tends to be a permanent one.

Figure 5: Post-abandonment treatment history, oral targeted therapy, all tumor types, 2020-2022

Note: Tumor types include breast, lymphoma, leukemia, prostate, and non-small cell lung cancer; Patients must have at least 30 days of data post-abandonment to be included

Source: IQVIA LAAD data, US Market Access Strategy Consulting

Discussion

A wide variety of factors impact a cancer patient’s treatment journey; although, not all of them are as obvious as others. Payer control and patient choice dynamics on treatment initiation are well-known, but many believe that these barriers apply only to new patients at the start of their treatment. As this blog has shown, that is a misconception. Not only are second- and third-line patients facing similar rejection rates to first-line patients, but abandonment rates increase, and a greater proportion of patients fall off therapy completely.

Patients in later line therapies represent a previously understated group facing considerable market access challenges. With the rise in formulary exclusions in oncology and the documented harmful effect prior authorizations play on patient outcomes4, patients who are more advanced in their disease face the same or greater barriers to accessing treatment as those just beginning the process. Additionally, as the onset of the Inflation Reduction Act (IRA) looms and payers will be responsible for the majority of costs in the Catastrophic phase of Medicare coverage – with a lower $2,000 out-of-pocket for patients – possible tighter control for expensive medicines, like oral oncolytics, is expected in Medicare. The effects of the IRA on Commercial patients are still unknown, but spill-over effects on utilization management are anticipated. This, together with the increased abandonment and patient drop-off in later lines, reveals an increasingly prohibitive landscape for cancer patients at all stages in the disease.

At the heart of all this is the patient. Patients must face the obstacles to life-saving medications and must make the choice of what their future treatment journey will look like. As highlighted here, the choice to initiate and continue care is more complex than just the obvious factors of approval and affordability, and until more of the obscure aspects of the patient journey, such as line of therapy, are considered, there will always be unanswered questions about the patients who seem to fall through the cracks.

References

- https://www.iqvia.com/insights/the-iqvia-institute/reports/the-global-use-of-medicines-2023

- https://www.iqvia.com/locations/united-states/library/white-papers/controlling-cancer-care-the-expansion-of-formulary-exclusions-in-oncology

- Ibid.

- ASCO Prior Authorization Survey, December 2022; Prior Authorization | ASCO

IQVIA’S Market Access Center of Excellence

Related solutions

Gain high value access and increase the profitability of your brands